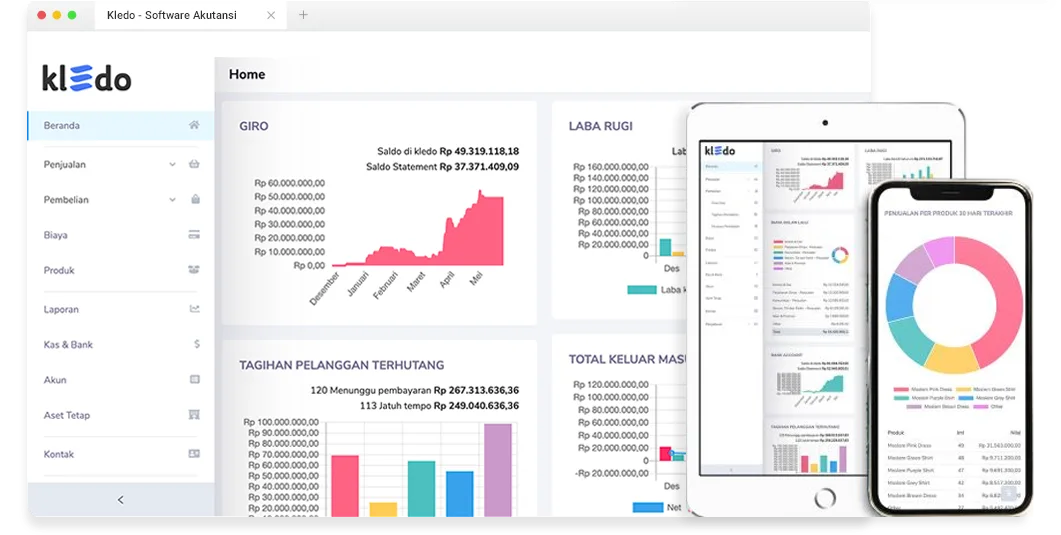

Enhance your credit union’s financial management with Kledo accounting software

Save time and provide better service to your credit union members with automated bookkeeping and efficient financial processes using Kledo.

The Challenges of Credit Union Accounting

Managing accounting in credit unions comes with unique challenges. Without the right processes and tools, keeping financial data transparent and accurate can be difficult.

Unmanaged Transactions

As your credit union grows, so does the number of transactions. Without proper management, tracking becomes overwhelming.

Non-Transparent Bookkeeping

nadequate financial reporting compromises transparency, even though it’s crucial for all members to have clear insights into the financial health of the union.

Improper Asset Management

Regularly assessing asset values is essential to understanding financial health, but depreciation is often overlooked.

How Kledo Helps Credit Unions in Indonesia?

Track Your Finances Anytime, Anywhere

With Kledo’s mobile app, you can monitor your credit union’s financial processes directly from your phone. Download it from Playstore and Appstore now.

Record Operational Expenses with Ease

Easily track every operational cost, wherever and whenever you need. No more waste—everything is optimized.

Automate Asset Depreciation Calculations

Say goodbye to manual depreciation calculations. Kledo automatically generates monthly asset adjustment journals.

Generate Financial Reports in Seconds

Quickly generate accurate reports, and get visual insights to make faster business decisions.

Learn More

Efficient Purchasing Management

From tracking purchases to generating invoices automatically, Kledo streamlines your credit union’s purchasing process.

Learn More

Enhanced Security with Multi-User Access

Kledo ensures your financial data is protected 24/7. You can also set user access permissions to ensure secure data management.

Learn More

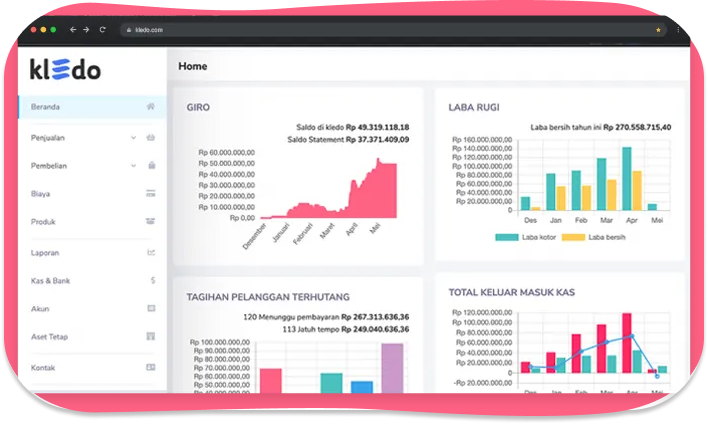

Easier Credit Union Accounting with Kledo

A credit union thrives on the prosperity and benefits of its members. Kledo accounting software supports this process by offering top-tier features and services for more efficient bookkeeping.

Bring Modern Accounting to Your Credit Union

With Kledo, you can easily record, manage, and analyze financial data, making accounting processes simpler.

Effortless Loan Tracking

Every transaction is automatically recorded following accounting procedures, generating financial reports that meet standards.

Secure Financial Access

Kledo’s access control feature ensures that all your financial data is protected, maintaining the confidentiality of your credit union’s information.

Other Features for Your Credit Union

- Multi Currency

- Budgeting

- Transaction Approval

- Subsidiary Consolidation

- 50+ Financial and Business Reports

Choose the Right Plan for Your Business:

Select the plan that fits your credit union’s needs. No hidden fees, and you can cancel anytime.

Save 35% with annual subscription

-

1 User

-

Expense monitoring

-

Sales & purchasing

-

Monitor cash & bank balance

-

Includes Free Plan Features

-

1 User

-

1 Warehouse

-

Complete Business Flow

-

Stock Management

-

Multi Location and Multi Project

-

Includes Pro Plan Features

-

2 Users

-

10 Warehouses

-

Manufacturing Products

-

Marketplace Connect***

-

Advanced Sales Commission

-

Custom Invoice Template ***

-

Join Invoice

-

Includes Elite Plan Features

-

5 Users

-

20 Warehouses

-

Budgeting

-

Subsidiary Consolidation

-

Multi-Currency

-

Approval

-

Proforma Invoice

****Custom invoice templates & marketplace connect are available in the Elite package and above, with optional add-on purchases.

View package comparison for full details.Words That Speak Volume

-

“For my newly-founded business, Kledo has helped a lot! It is rich in features, simple, and easy to use even for those who are not familiar with accounting.”

Ferry Wiharsato

Co Founder Kerjoo

-

“Kledo has a simple interface that helps us manage business finances effortlessly. It also comes with comprehensive features, we can record incoming order, payment, and even create invoice for customer who haven’t completed their payment.”

Pria Bagus Adi Wijaya

Niffly Jewerly

-

“Kledo Customer support’s explanation was helpful and easy to understand. Turns out using accounting software isn’t as difficult as we thought.”

Mariana Ros Afianti

Owner Batiklurik.id

Contact Us to Learn More About Kledo

Interested in exploring how Kledo can improve your business processes? Consult your needs and schedule a demo with the Kledo Team through the link below:

Scheduling A DemoFrequently Asked Questions

Is Kledo really free?

How is Kledo’s pricing calculated?

What is needed to use Kledo?

Are there any additional costs for personal assistance with Kledo?

Why should credit union’s use Kledo accounting software?

What is the role of accounting software for credit union’s?

Which is better: online accounting apps or desktop-based apps?

Are there any free accounting software options?

What are the best accounting software for credit union’s in Indonesia?

How to choose accounting software for a credit union?

What essential features should accounting software for credit union’s have?

- Transaction Recording: This feature makes it easy to record all financial transactions, such as purchases, sales, payments, and more.

- Financial Report Generation: This feature lets you create financial reports like balance sheets, profit and loss statements, and cash flow reports. These are crucial for understanding your credit union’s financial position.

- Third-Party App Integration: This feature allows you to integrate your accounting software with third-party apps, such as marketplaces, online stores, POS systems, and more. This helps you manage your credit union more efficiently.

- Customer Support: This feature provides the support you need if you encounter difficulties, questions, or issues with the software. It’s essential to ensure smooth usage.

Is Kledo secure to use?

Got questions? Reach out to us on WhatsApp:

+62 852 3230 0100